FbF bioCOLLECT

A mobile app for Android and iOS that allows users to capture/save biometric and demographic information

Capture and save fingerprint images when you subscribe through In-App purchases

Download from the Apple App Store and Google Play Store

Improve acquisition, conversion, and retention

Cutting-edge companies in the know are embracing new biometric customer identity and access management technologies (CIAM) to replace how they connect online with potential or existing customers for improved acquisition, conversion, and retention.

The objective is to protect customer identities and prevent misuse of their data and ensure that only the right people have the right access to the right information at the right time.

The CIAM features of FbF® bioKYC are critical because they keep your network, systems, applications, and data safe while simultaneously providing the access users need to perform tasks essential to your business success resulting in increased scalability, optimized customer experience and differentiation.

How It Works

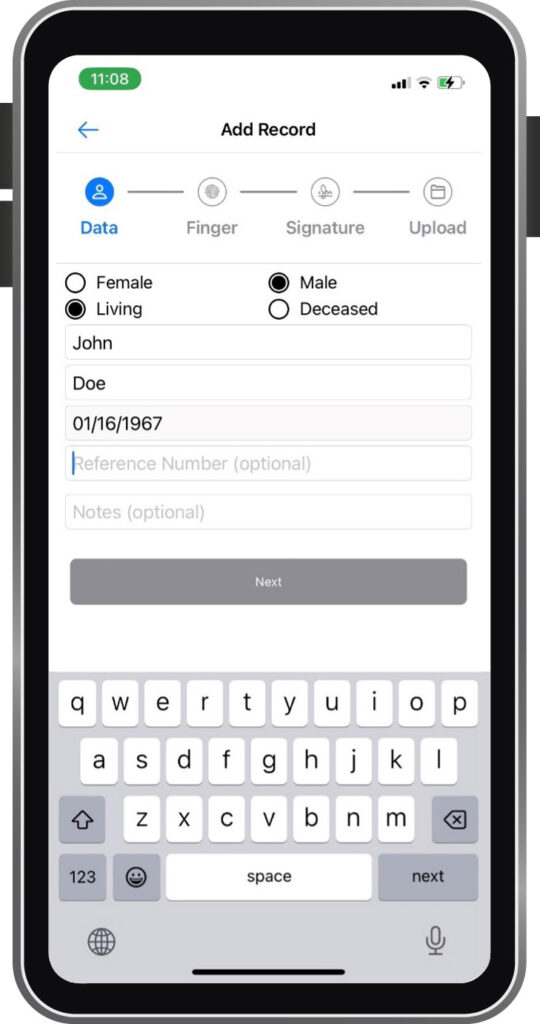

Add a new record

- Fill out the required fields and optional fields.

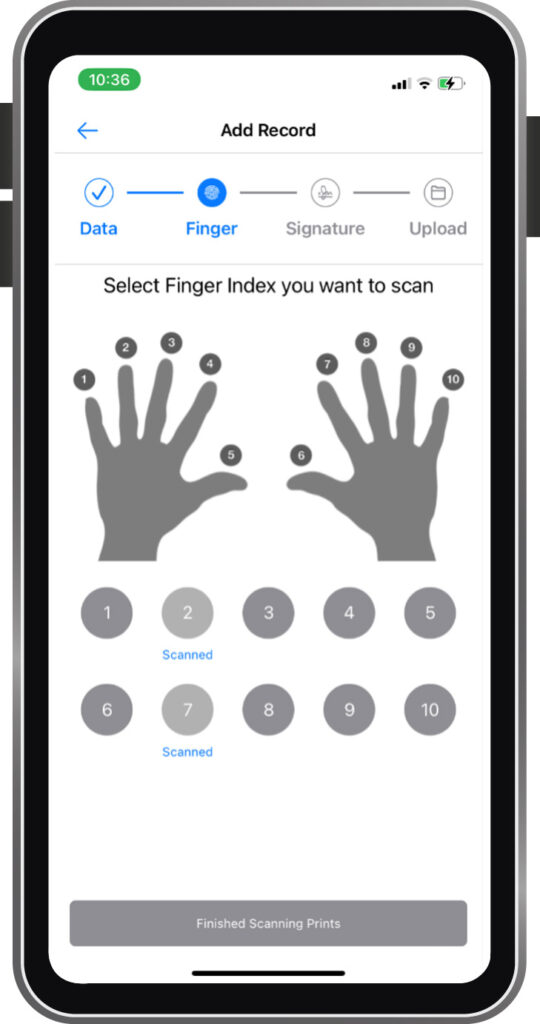

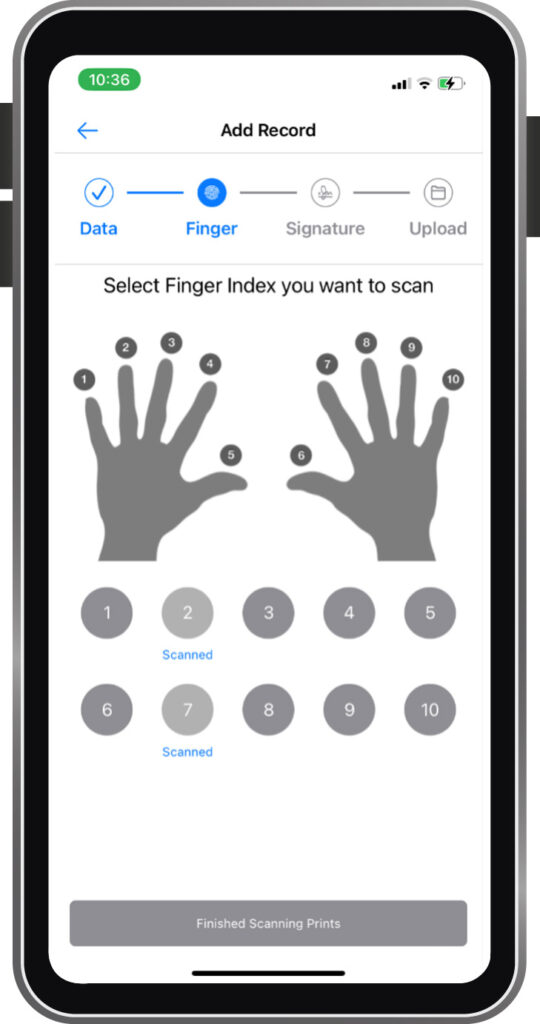

Select which finger to scan

- Scan one or more prints (up to all 10). Each finger is represented by a numbered circle.

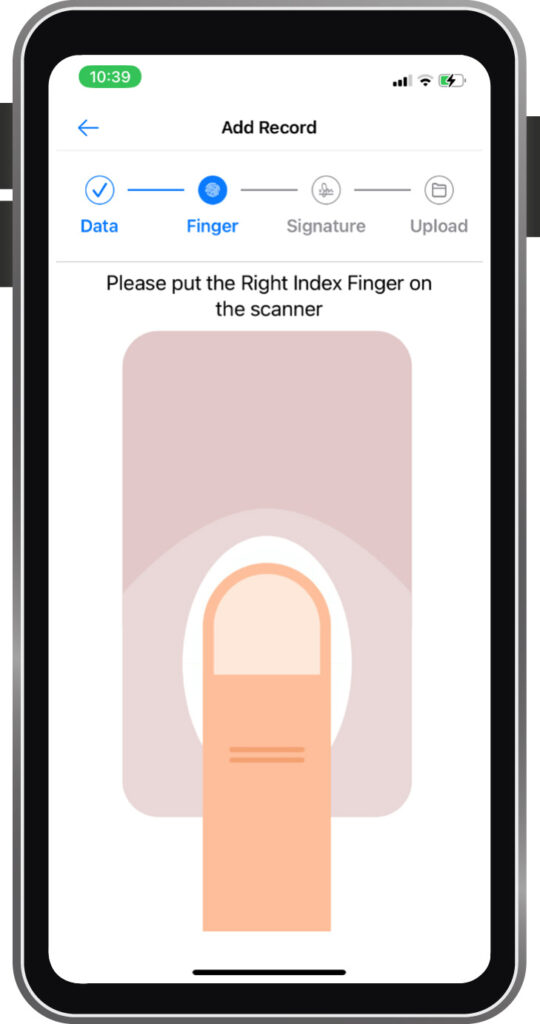

The capture screen asks to place your finger on the scanner

- Liveliness detection image verifies against the image on the authorized ID document

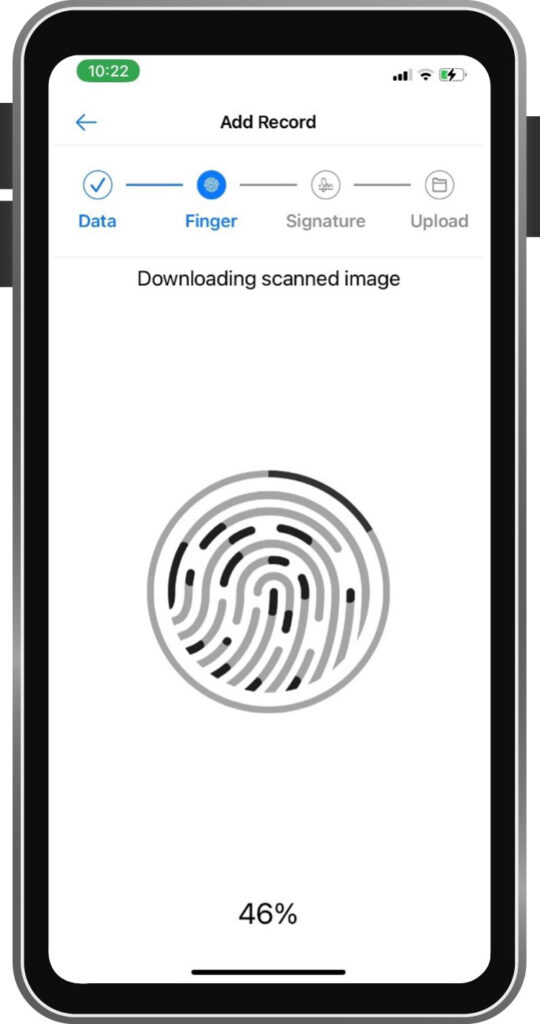

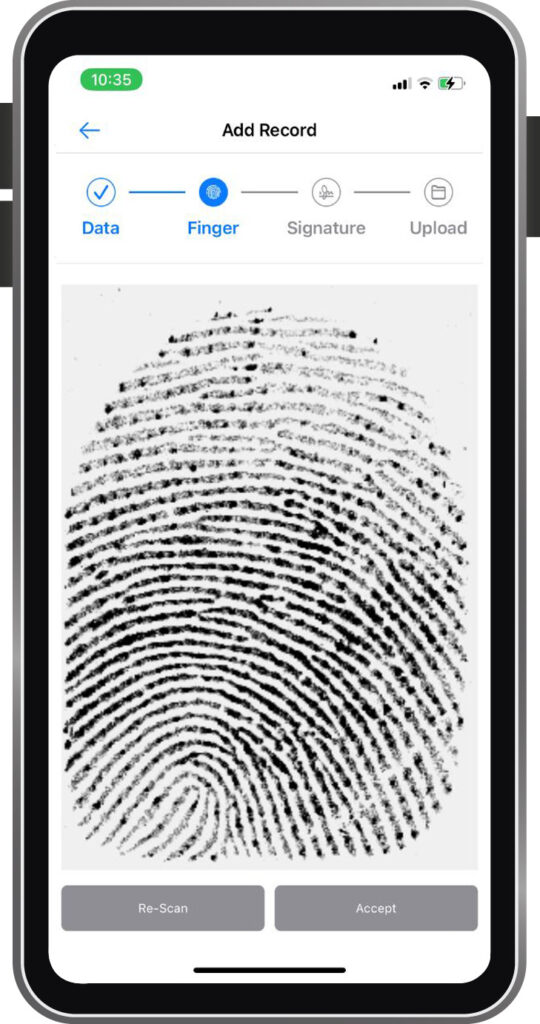

The scanned image downloads

- Liveliness detection image verifies against the image on the authorized ID document

Preview the captured fingerprint

- Customer is prompted to scan their ID document for proofing

Select additional fingers to scan if needed

- Customer is guided to take a selfie for identity comparison against the image on the authorized ID document

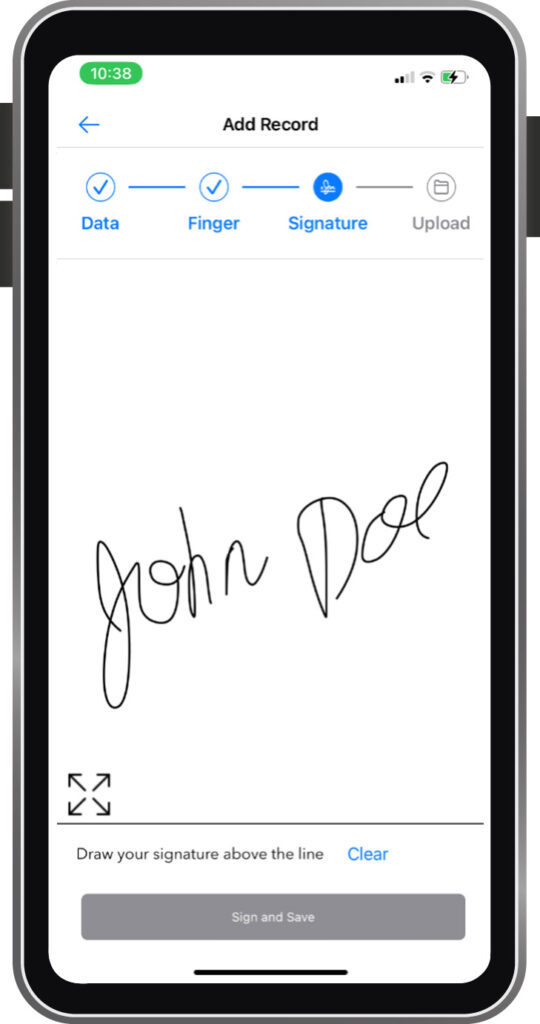

Capture a signature if needed

- Liveliness detection image verifies against the image on the authorized ID document

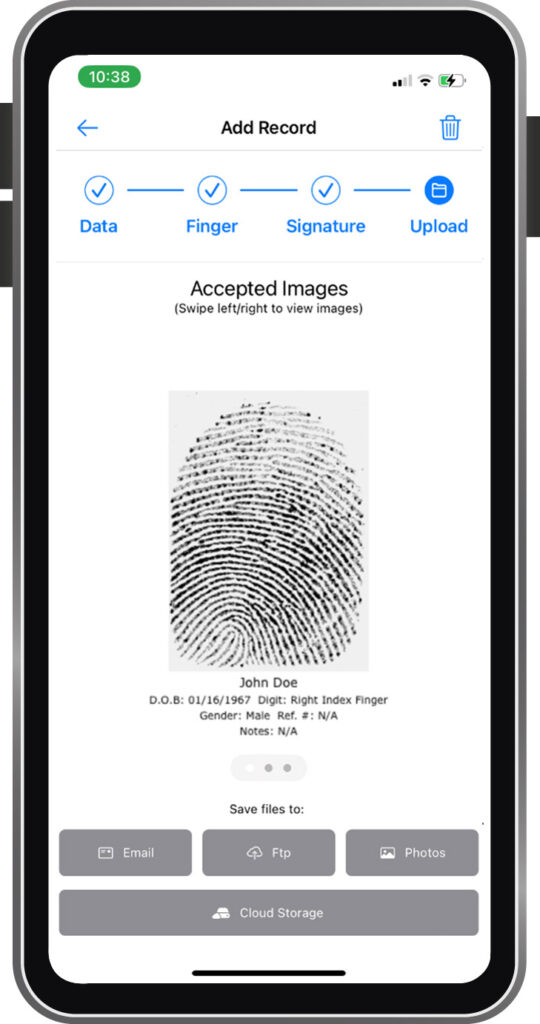

Store your record

- Liveliness detection image verifies against the image on the authorized ID document

Why Digital Onboarding?

How do you know if John is the real John if he is a thousand miles away?

In the old days, you either trusted John to be who he said he was (and crossed your fingers that he wasn’t lying), or you simply avoided doing remote business because the whole enterprise was too risky.

Not today.

Today, technology exists that allows an organization to correctly identify someone from any place in the world and know that they are properly credentialed for the task at hand. Developed in the banking world to help prevent money laundering, the ability to “digitally onboard” a customer with a mobile phone and know that the customer is who they say they are (known as Electronic Know Your Customer, or eKYC) is technology available for any organization. And, yes, biometrics is involved if you want to get it right.

So for banks, good digital onboarding makes it possible to sign up customers from anywhere, check their identity against driver’s licenses or passports and facial recognition, and know that their new customer is legitimate. But now construction and healthcare companies can confirm identities against licensing credentials. Retailers of restricted products like cannabis, liquor, or tobacco can eliminate the risk of dispensing to underage customers by a digital onboarding process that lets them know the customer really is of age. Universities can onboard students. Insurance companies can enable policies with accurate, lightning speed.

Could you expand your business by taking it global while eliminating the identity risks?